florida estate tax exemption 2020

Federal Estate Taxes. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year.

. If the date of death value of the decedents US-situated assets together with the gift tax specific exemption and the amount of the adjusted taxable gifts exceeds the filing threshold of 60000 the executor must file a Form 706-NA for the decedents estate. To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers Certificate of Exemption Form DR-14 from the Florida Department of Revenue. Estates of Decedents who died on or after January 1 2005.

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption that would decrease the propertys taxable value by as much as 50000. The estate tax exemption for 2020 is 1158 million per decedent up from 114 million in 2019. What this means is that estates worth less than 117 million wont pay any federal estate taxes at all.

The estate and gift tax exemption is 1158 million per. The historically high lifetime exemption amount for gift estate and generation-skipping transfer taxes increased from 114 million to 1158 million on January 1 2020. As mentioned Florida does not have a separate inheritance death tax.

Technically this is structured as a tax credit. 3 Oversee property tax. The federal estate tax only applies if the value of the entire estate exceeds 12060000 million 2022 and the tax thats incurred is paid out of.

This may sound complicated but the end result is actually quite simple. The United States government or any of its federal agencies is not required to obtain a Florida Consumers Certificate of Exemption. First Responders Physician Certificate of Total and Permanent Disability Sample.

Estate Tax Rate Floridas estate tax rate varies on a marginal tax bracket according to your net worth. A person may be eligible for this exemption if he or she meets the following requirements. No Florida estate tax is due for decedents who died on or after January 1 2005.

Real Property Dedicated in Perpetuity for Conservation Exemption Application R. SmartAsset has a In estate planning it is key to know how much your assets total including your savings. 11292020 Federal Estate Gift and GST Tax.

Florida estate planning lawyers help people develop a family or business-friendly strategy to maximize tax savings tax cuts and deductions when they pass. This exemption qualifies the home for the Save Our Homes assessment limitation. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023.

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. Estate Tax Exemption for 2021. November 19 2019 Posted by RLA Estate Planning Law News and Press Probate Real Estate Law Tips Trust Administration The estate tax exemption for 2020 is 1158 million an increase from 114 million in 2019.

View Federal Estate Gift and GST Tax Exemptions Update 2020pdf from TAX 6726 at University of Florida. Application deadline for additional ad valorem tax exemption for specified deployments. The 2020 limit after adjusting for inflation is 1158 million.

Owns real estate and makes it his or her permanent residence Is age 65 or older Household income does not exceed the income limitation see Form DR-501 and Form DR-501SC see section 1960752 Florida Statutes. Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021. Florida also has no gift tax.

Estate tax is calculated on all of your assets when you die and theres a nonrefundable credit equal to the tax that would be charged on the lifetime exemption 4577800 in 2020. The Internal Revenue Service announced today the official estate and gift tax limits for 2020. The filing threshold for Form 706-NA is not indexed for inflation.

Any assets left to your heirs will be taxed at a 0 rate up to 1158. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023. Original Application for Homestead and Related Tax Exemptions R.

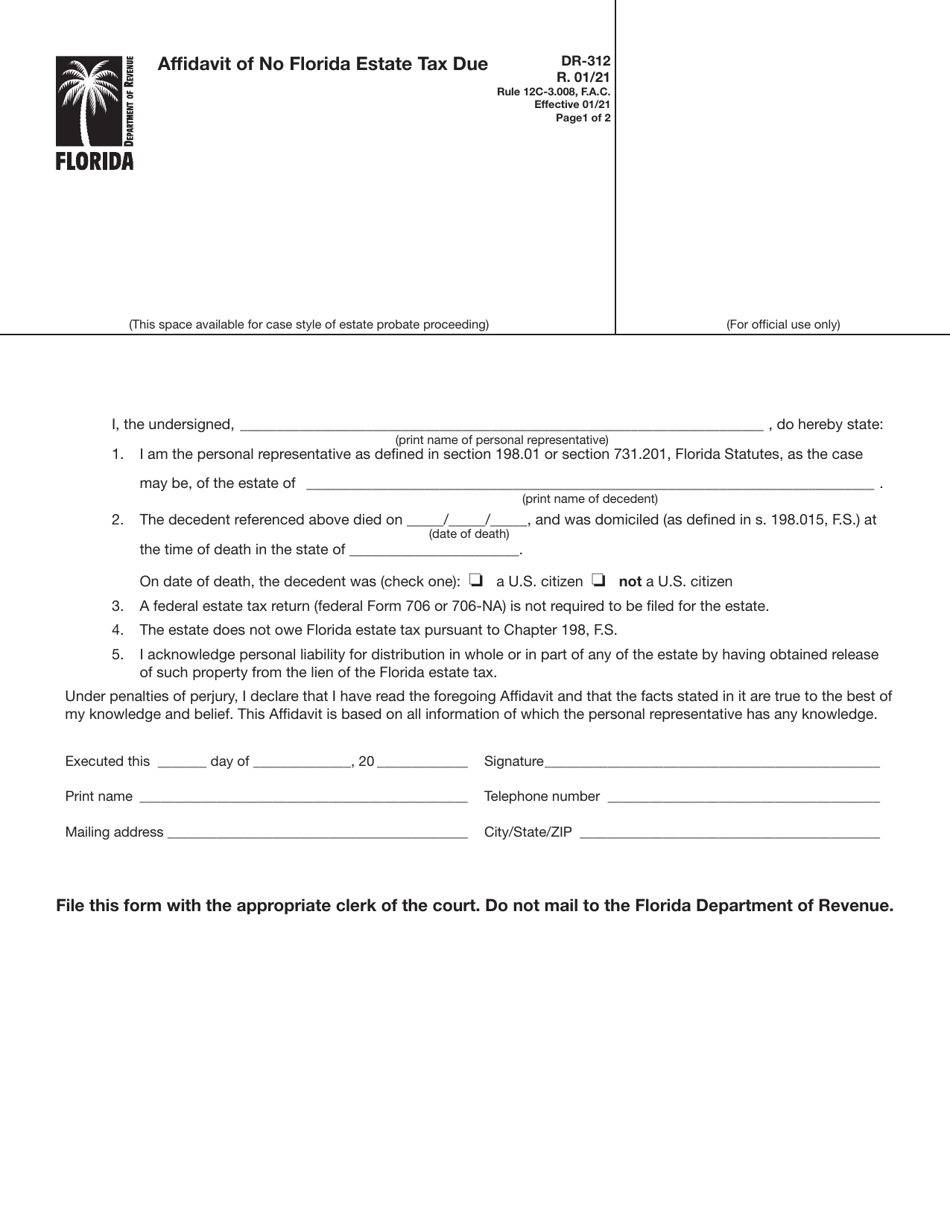

For example if someone who dies in florida owns valuable property in another state. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due. DOC 60 KB PDF 306 KB DR-501.

196173 Florida Statutes for the 2020 tax roll is. DOC 84 KB PDF 210 KB Sample. The federal government however imposes an estate tax that applies to all United States Citizens.

The current exemption doubled under the Tax Cuts. At the forefront of e-commerce business. The size of the estate tax exemption meant that a mere 01 of estates filed an estate tax return in 2020 with only about 004 paying any tax.

2020 estate tax exemption november 19 2019 posted by rla estate. The current federal tax exemptions are at 117 million in 2021.

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

3 Transfer Taxes To Minimize Or Avoid In Your Estate Plan

Inheritance Tax In Florida Legal Guide For 2022 Alper Law

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Will My Florida Estate Be Taxed Nici Law Firm P L Naples Fl

Florida Estate Tax Rules On Estate Inheritance Taxes

Inheritance Tax In Florida Legal Guide For 2022 Alper Law

Florida Attorney For Federal Estate Taxes Karp Law Firm

U S Estate Tax For Canadians Manulife Investment Management

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax In Florida The Finity Law Firm

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl